In the world of online commerce, we, a payment facilitator (PayFac) plays a crucial role in enabling seamless transactions. Apart from facilitating payments, we also shoulder the responsibility of safeguarding your business and your customers from financial risks.

The online environment presents unique challenges for businesses, especially when it comes to financial security.

Understanding the Risks |

Fraudulent Transactions

Counterfeit cards, stolen credit card details, and unauthorised purchases are constant threats.

Chargebacks

Customers disputing charges can create financial burdens for merchants.

Money Laundering

Payment facilitators need to be vigilant against attempts to use their platform for illegal activities.

Full

Compliance

Based on the above condition, this has led to a greater emphasis on compliance with industry regulations and best practices, ensuring that payment systems are not only convenient but also safe and trustworthy.

we prioritising compliance, businesses build confidence in their systems, foster consumer trust, and ultimately contribute to a more secure and flourishing online marketplace.

Two-Factor Biometric Authentication

Two-factor authentication (2FA) enhances security by adding an extra layer to the user authentication process. Biometric security measures, like facial or fingerprint recognition, ensure legitimate transactions by verifying the user’s identity each time a request for digital asset transfer is made.

Device Binding

Users can only access the Mobile App from a specific mobile device if they bind their account to it.

Password-Proteched Access

A strong, secure login password verifies a user’s identity before granting access to their account.

Session Logout

To enhance account and fund security, the system automatically logs users out after a period of inactivity.

Tamper Detection

Our mobile app incorporates a tamper detection mechanism that identifies alterations to the app’s code, including injections, binary patching, and modifications to Java bytecode. Upon detecting a jailbroken device, the app will temporarily suspend user access to all its features.

Role-Based Access Control

Role-based access control (RBAC) or role-based security is an approach we adopted on our application level to restricting system access to authorised users. Staff is only allowed to access the information necessary to effectively perform their job duties. Access can be based on several factors, such as authority, responsibility, and job competency. In addition, access to computer resources can be limited to specific tasks such as the ability to view, create, or modify a file.

System Log

We enable traceability by configuring event logs. This allows operator to monitor remote access logs and follow up on any suspicious activity as well as logging account logins, system configuration changes, and permission changes.

Our system design also back up logs to a separate log server as an archive.

Network Security Group

A security group safeguard the system and data from an infrastructure perspective, it controls the traffic that is allowed to reach and leave the resources that it is associated with. For example, after you associate a security group with an Amazon EC2 instance, it controls the inbound and outbound traffic for the instance. For each security group, we can add rules that control the traffic based on protocols and port numbers. There are separate sets of rules for inbound traffic and outbound traffic.

Effective

RegTech

By focusing on the pain points of many banks, we partner with Earth Channel, the winner of HSBC Safeguard Competition, strive to leverage, develop and implement Artificial Intelligence and Blockchain based solutions and services which aimed to help the Banking and Finance industry to add better value in light of a even more demanding Compliance and Regulatory requirement nowadays.

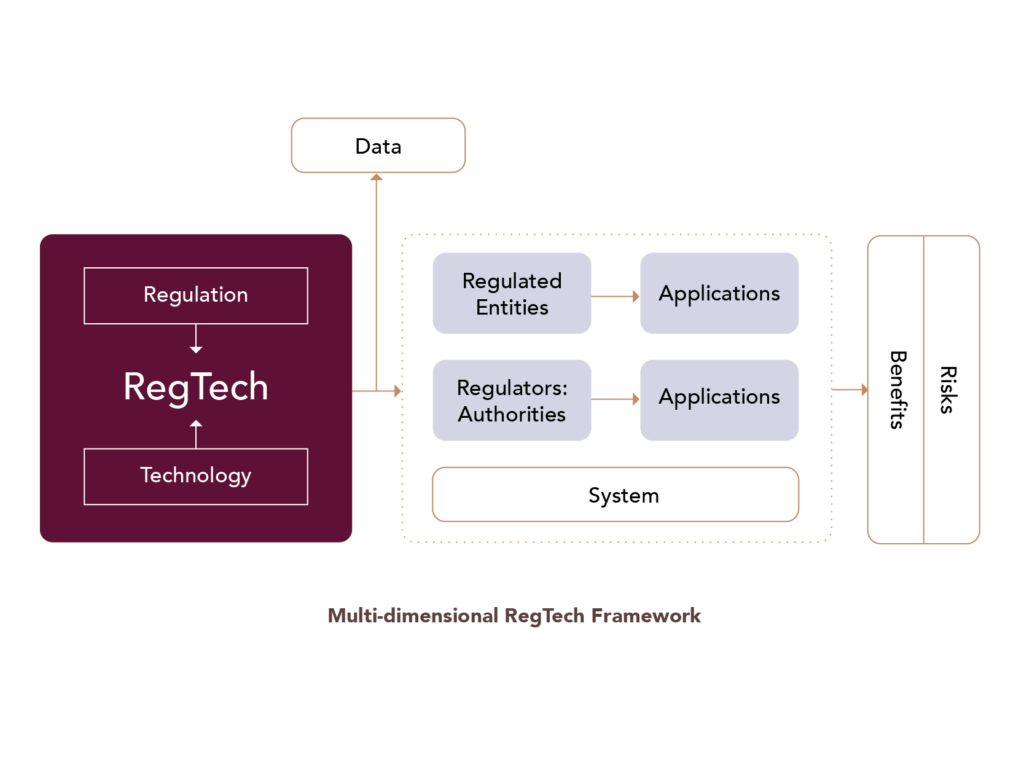

What is RegTech?

RegTech, short for Regulatory Technology, is a rapidly growing field that uses technology to improve compliance and efficiency in the financial services industry.

It encompasses a broad range of tools and solutions, including software for anti-money laundering (AML) and know-your-customer (KYC) checks, automated reporting platforms, and data analytics for risk management.

RegTech aims to reduce the burden of regulatory compliance for financial institutions, improve accuracy, and ultimately enhance consumer protection.